The Government has announced an extension of two months for filing income tax from the original deadline in consideration of the Movement Restriction Order MRO that has been enforced during the COVID-19 pandemic. Business income B Form on or before 30 th June.

Pin By Hi Accounts On Accounting Software For Gst Accounting Positive Outlook Accounting Software

The due date for submission of form be for year of.

. The deadline to file the 2017 tax return is October 15 2021 if you received an extension. Corporate tax is paid before 20 May of each year. For Labuan entities taxed under the Malaysia Income Tax Act 1967 ITA the 3-months extension only applies to taxpayers whose accounting period ended on 30 November 2020 and 31 December 2020.

30062022 15072022 for e-filing 6. Companies are required to furnish estimates of their tax payable for a year of assessment no later than 30 days before the beginning of the basis period normally the financial year. Individual Tax Relief in Malaysia.

The e-Filing system for submission of Form E for the year of Remuneration 2016 will be opened beginning 1 March 2017. Form B Form B deadline. The new 45-page Guidelines replace the earlier Operational Guidelines No.

62017 Date Of Publication. Tax Rate of Company. Form C refers to income tax return for companies.

Employment income BE Form on or before 30 th April. Register for Self Assessment if youre self-employed or a sole trader not self-employed or registering a partner or partnership. E-Filing System Opens on 1 March 2017.

A At least 10 of the persons total number of patients consist of foreign clients who have obtained private healthcare services in each YA and b At. Declaration report of companies Form E deadline. Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis.

Beginning year of assessment 2020 a company has to self assess income tax payable and submit the declaration to LHDN using Form C. Income tax return for individual with business income income other than employment income Deadline. Form EA Important Notes.

Income tax return for individual who only received employment income. PERSONAL TAX Form BE 30 April 2022. The income tax exemption is equivalent to 100 of the value of the increased exports of services to be set-off against 70 of statutory income on condition that.

June 1st is the submission deadline for Short Sweet Malaysia 2017Click here for more info. Extended from 15 July 2021 to 31 Aug 2021 according to LHDN. The key changes are outlined below.

Employment income e-BE on or before 15 th May. BE - Return Form of an individual resident who does not carry on a business the deadline is April 30. Bayaran Taksiran LBATA 24Aktiviti Perdagangan 27.

SOLE PROPRIETOR Form B PARTNERSHIP Form P 30 June 2022. Form E Important Notes. Income tax return for partnerships Form P.

Income tax return for partnership. Albania Last reviewed 21 June 2022 31 March. SDN BHD Form C 7 months after financial year end.

Penalties up to 45 for non compliance to Income Tax Act. The tax submission deadline under ITA is usually within 7 months after the end of accounting period. Useful reference information for malaysias income tax 2018 filing deadline for year of assessment 2017 for be is apr 30 2018 manual form.

Individual Tax in Malaysia. The new Guidelines. A Form E deemed not received is a failure to comply and is an offence under Paragraph 1201b of the Income Tax Act ITA 1967.

12017 dated 23 February 2017 see Tax Alert No. 2022 tax filing deadlines. 30042022 15052022 for e-filing 5.

LEMBAGA HASIL DALAM NEGERI MALAYSIA HASiL ANJUR PERSIDANGAN PERCUKAIAN KEBANGSAAN 2022 KALI KE-22. Instalments are due on 20 March 20 June and 20 November equal each to 30. Either in Malaysia or from Malaysia to foreign clients.

Kuala Lumpur 02 Ogos 2022 - Lembaga Hasil Dalam Negeri Malaysia HASiL dengan kerjasama Chartered Tax Institute of Malaysia CTIM hari ini menganjurkan Persidangan Percukaian Kebangsaan 2022 National Tax Conference 2022. CIT estimated payment due dates. Personal income tax filing Form BE deadline.

Business income e-B on or before 15 th July Date of. Income tax return for companies. The new deadline for filing income tax returns in Malaysia is now 30 June 2020 for resident individuals who do not carry on a.

However with this extension taxpayers have a total. Tax Deadline Year 2022. The new Guidelines are broadly similar to the earlier guidelines and provide clarification on the procedures for the submission of tax estimation forms.

Go to my account and click on refunddemand status. Upon conviction employers may be. Algeria Last reviewed 01 June 2022 Before 30 April of the following fiscal year.

Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts. 15th day of each month or end of each quarter. Inland revenue board of malaysia.

Yearly remuneration statement Form EA Deadline. Filing deadline of 30 june 2017 granted by the irb. Bayaran Taksiran LBATA 24Aktiviti Bukan Perdagangan Company.

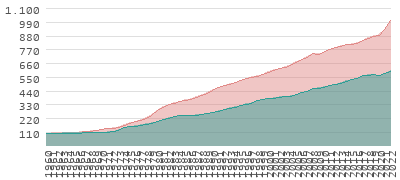

An Analysis Of Malaysian Rubber Glove Industry Blogs Televisory

Contoh Payslip Gaji Swasta You Can Slip Wecanfixhealthcare Info Office Word Word Template Resume Design Free

Kpmg Survey Of Corporate Responsibility Reporting 2017 Kpmg Global

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Do You Need To File A Tax Return In 2018

Roundup Of Cloud Computing Forecasts 2017

Roundup Of Cloud Computing Forecasts 2017

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Malaysia Payroll And Tax Activpayroll

Business Tax Deadline In 2022 For Small Businesses

Ouat Admit Card 2018 Download Cee Hall Ticket By Name No Date Medical Test Upsc Civil Services Civil Service Exam

Pin On Free Classified Ads For Cars

P Cecilia I Will Provide Accounting And Tax Services Malaysia For 190 On Fiverr Com Accounting Services Tax Services Bookkeeping Services

Global Student Mobility Trends Focus On Japan Malaysia Taiwan And South Korea

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Roundup Of Cloud Computing Forecasts 2017